- #BEST PERFORMING MUTUAL FUNDS 2019 CATEGORY HOW TO#

- #BEST PERFORMING MUTUAL FUNDS 2019 CATEGORY SERIES#

- #BEST PERFORMING MUTUAL FUNDS 2019 CATEGORY FREE#

Fund Manager : The decisions and strategies of the fund manger are directly responsible for the performance of the best sip scheme of SBI.

These schemes have limited the drawdown in the negative market and delivered higher return in the positive market conditions. The Top SBI Mutual Fund schemes have been the better one when compared to the index and most of the peers under different market conditions.

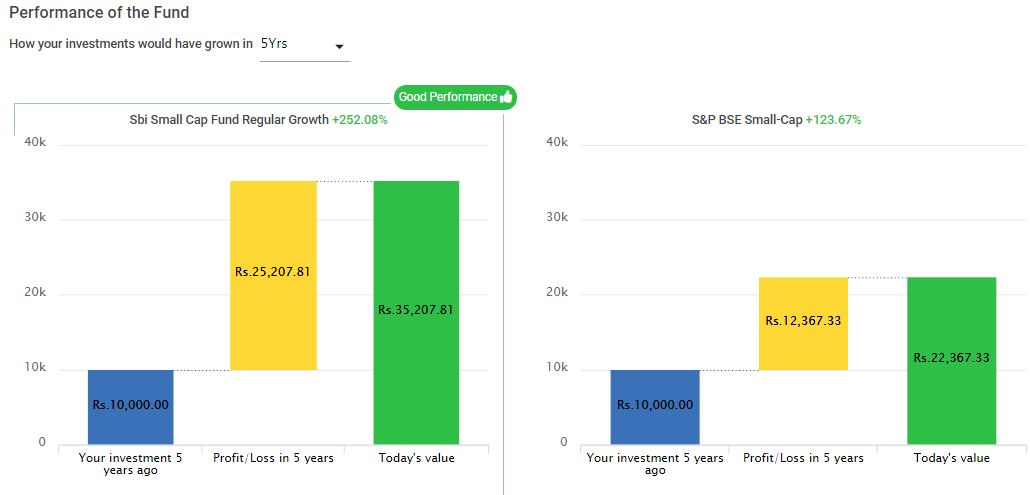

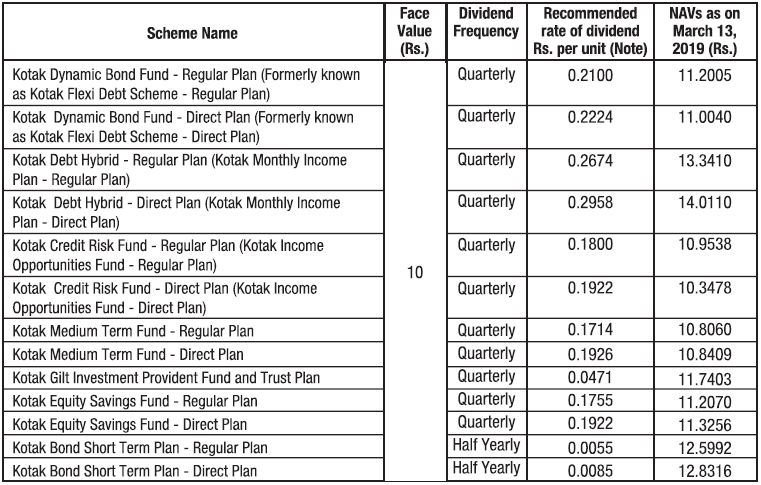

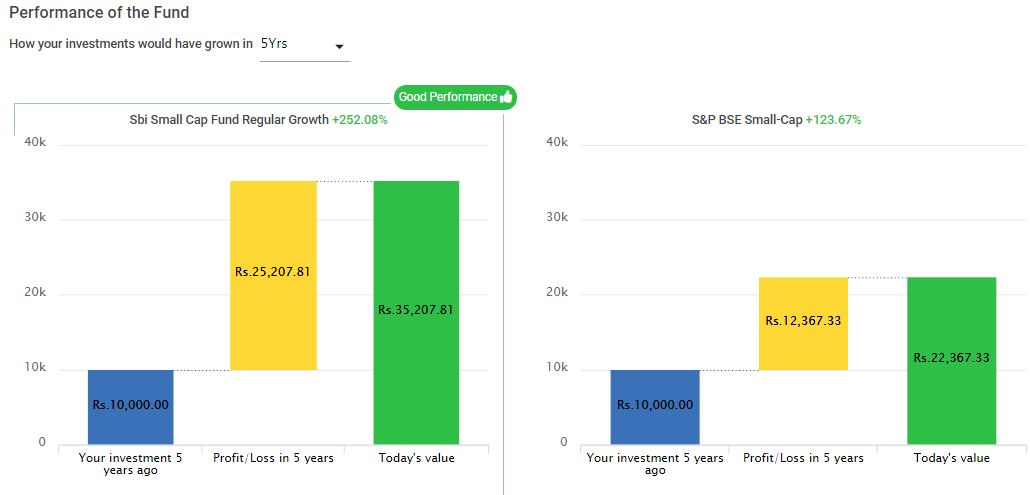

Consistency : If we look at the track record of the best schemes of SBI, the funds have been a notch performer because of the consistency in returns. INVEST IN MUTUAL FUNDS What Separates the Best SBI Mutual Fund Schemes from the Ordinary ones? It is among the best scheme in the category. SBI Equity Hybrid Fund : This is an aggressive hybrid scheme which has higher allocation in the equities and lower in the debt. The fund has higher allocation in the debt instruments and lower allocation in the equities to ensure stable growth. SBI Magnum Children Benefit Fund : It is a conservative hybrid fund which aims for the financial welfare of the children’s future education. Top SBI Mutual Fund to Invest in 2019 in Hybrid Category The fund invests in the stocks of banking industry and is a consistent performer for a long time. SBI Banking & Financial Services Fund : This sectoral fund has been one of the top schemes in SBI Mutual Fund. This scheme is best-suited for long-term SIP. SBI Small Cap Fund : It is one of the most aggressive schemes in India but has the ability to generate highest of returns under the favourable market conditions. It is a large-cap fund and is suitable for long-term investment. SBI Bluechip Fund : This fund seeks the stocks with bluechip quality among the top 100 stocks of the stock market. The best SBI Mutual Fund Schemes for long term are available in the category of large-cap, mid-cap, small-cap, multi-cap, and sectoral mutual funds. Some of the best SBI Mutual Fund have delivered highest returns in the respective category and consistently defeated the benchmark and category’s average. These funds have high risk but have generated remarkable returns for the investors since a long time. The corpus is invested in the equity instruments according to the objective of the scheme. The equity schemes provided by SBI Mutual Fund are mechanised to deliver long-term wealth to the investors. It has followed innovative strategies to enhance the performance of the schemes. It has been managing more than 5.4 million mandates of the investors and has a significant contribution in the growth of mutual funds industry in India. With more than 30 years of experience, SBI MF has consistently delivered superior schemes to the investors in every category of mutual funds. Apart from these, some of the best SBI Schemes are also launched for specific financial solution like child planning. The top SBI Mutual Fund plans are available in the category of equity, debt, and hybrid mutual fund. What Separates the Best SBI Mutual Fund Schemes from the Ordinary ones?. Best performing SBI Funds are available to invest in the equity, debt, and hybrid category.

Learn how to evaluate the SBI mutual fund schemes for yourself for a superior financial planning. (Disclaimer: past performance is no guarantee for future performance.Out of a wide variety of best SBI Mutual Fund, choose the top SBI Mutual Funds selected by our experts after an extensive research.

[Risk Free Rate + Beta of the MF Scheme * Īsset size: For Equity funds, the threshold asset size is Rs 50 crore Higher Alpha indicates that the portfolio performance has outstripped the returns predicted by the market.Īverage returns generated by the MF Scheme = Jensen's Alpha shows the risk-adjusted return generated by a mutual fund scheme relative to the expected market return predicted by the Capital Asset Pricing Model (CAPM). Outperformance: It is measured by Jensen's Alpha for the last three years. Z = Y/number of days taken for computing the ratio The larger the value of H, the stronger is the trend of the seriesĭownside risk: We have considered only the negative returns given by the mutual fund scheme for this measure.

Ii) When H 0.5, the series is said to be persistent. These type of time series is difficult to forecast. I) When H = 0.5, the series of return is said to be a geometric Brownian time series. Funds with high H tend to exhibit low volatility compared to funds with low H. The H exponent is a measure of randomness of NAV series of a fund. Mean rolling returns: Rolled daily for the last three years.Ĭonsistency in the last three years: Hurst Exponent, H is used for computing the consistency of a fund. ET.com Mutual Funds has employed the following parameters for shortlisting the Equity mutual fund schemes.

0 kommentar(er)

0 kommentar(er)